401k contribution calculator per paycheck

Increasing your contribution will help you reach your retirement savings goals and it will also help you lower how much you pay in taxes. The cpi calculator consumer price index calculator exactly as you see it above is 100 free for you to use.

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Free calculator to find the actual paycheck amount taken home after taxes and deductions from salary or to learn more about income tax in the US.

. Use the paycheck calculator to figure out how much to put. A half times their regular rate of pay. If you want to customize the colors size and more to better fit your site then pricing starts at just 2999 for a one time purchase.

Youll be taking advantage of dollar-cost averaging tax-deferred growth and a possible company match. The rent per square foot calculator exactly as you see it above is 100 free for you to use. The 401ks annual contribution limit of 20500 in 2022 27000 for those age 50 or older.

While your plan may not have a deferral percentage limit this calculator limits deferrals to 80 to account for FICA Social Security and Medicare taxes. Employers can choose to match employee contributions usually up to a certain percentage of the employees paycheck. If you want to customize the colors size and more to better fit your site then pricing starts at just 2999 for a one time purchase.

Contribute to your 401k. Contribution Calculator Contributing to your workplace 401k is one of the best investment decisions you can make. There is no income limit for a Roth 401k.

Please note that your 401k or 403b plan contributions may be limited to less than 80 of your income. Check with your plan administrator for details. Total including employer contribution.

Subtract any deductions and payroll taxes from the gross pay to get net pay. This number is the gross pay per pay period. Hourly Paycheck Calculator Enter up to six different hourly rates to estimate.

Due to this if allowed non-exempt. As of 2020 the 401k contribution limit for those aged 50 and below is 19500. Another thing you can do is put more of your salary in accounts like a 401k HSA or FSA.

Some employers even offer contribution matching. The average employer contribution dollar amount into 401ks in 2019 was 4100 which equates to a little bit more than 1000 per quarter Some 401k plans vest employer contributions. You may now make an additional pre-tax contribution to your plan if you reach age 50 during the calendar year and have reached either the plans or the IRS pre-tax contribution limit.

290 for incomes below the threshold amounts shown in the table. Free 401K calculator to plan and estimate a 401K balance and payout amount in retirement or help with early withdrawals or maximizing employer match. Payroll 401k and tax calculators.

Use PaycheckCitys 401k calculator to see how 401k contributions impact your paycheck and how much your 401k could be worth at retirement. Enter your wage hours and deductions and this net paycheck calculator will instantly estimate your take-home pay after taxes and deductions 2022 rates. If your employer offers a 401k plan consider contributing pre-tax money with every paycheck.

401k HSA etc withheld from. The maximum catch-up contribution available is 6500 for 2022. Try to meet or exceed their matching amount to make the most of your retirement savings.

The Roth IRAs after-tax contributions so qualified. The IRS contribution limit increases. Click the Customize button above to learn more.

Enter the total of any other before-tax deductions per pay period such as contributions to a Health Savings Account or a Flexible Savings Account. Use SmartAssets paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal state and local taxes. Money that you contribute to a.

If you contribute more money to accounts like these your take-home pay will be less but you may still save on taxes.

Net Worth Calculator Find Your Net Worth Nerdwallet

Compound Interest Calculator For Excel

401k Calculator

Monthly Gross Income Calculator Freeandclear

How To Budget When You Are Behind On Bills Setting Up A Budget Budgeting Money Budgeting

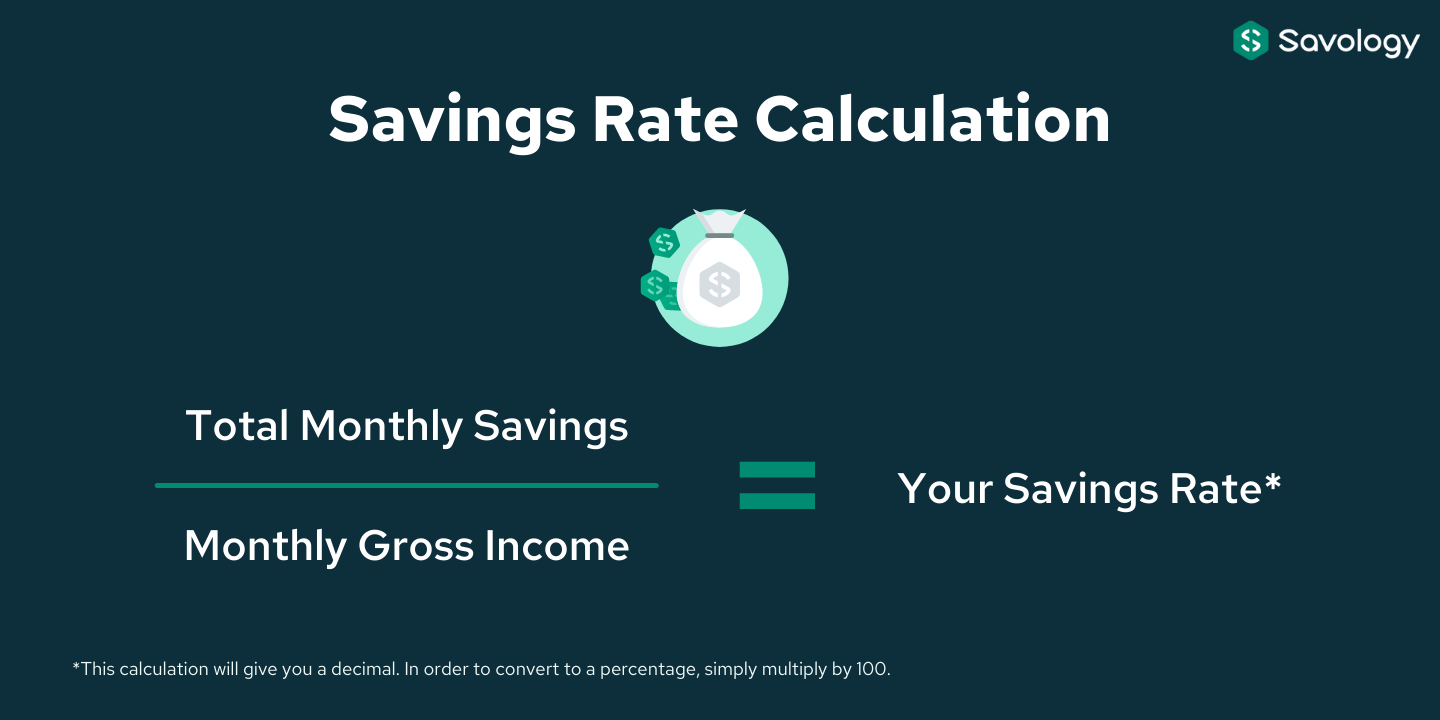

Savings Rate 101 What It Is And How To Calculate It Savology

401 K Calculator Mycalculators Com

Free Download A Visual Guide To Your Business Financial Statement Money Saving Tips Budgeting Money Money Management

Retirement Withdrawal Calculator For Excel

50 30 20 Budget Calculator

I Built A Spreadsheet To Calculate What It Would Take To Retire Early And It Was A Shock

4 Steps To Paying Off Debt Girltalkwithfo Com Credit Card Payment How To Calculate Credit Card Payment Cr Debt Payoff Debt Free Credit Card Debt Payoff

401k Contribution Calculator Step By Step Guide With Examples

I Created A Little Calculator To Figure Out Exactly What My 401k Contribution Election Should Be To Front Load It Early Each Year Reach The Annual Max And Still Get The Full

Employee Cost Calculator Updated 2022 Employee Cost Calculation

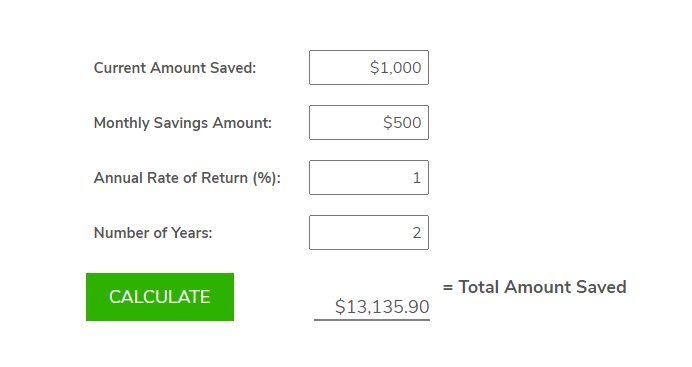

Free Simple Savings Calculator Investinganswers

Calculate Your Expected Employee Benefits Costs